Sustainability and affordability continue to drive the resale boom, and Q3 is where that momentum shows. Back-to-school shopping, late-summer splurges, and outdoor activities make this season a key opportunity for secondhand e-commerce growth.

Resale is on track to become a $1.04 trillion industry by 2035. According to eBay, 71% of shoppers aged 25 – 34 bought pre-loved goods last year. This highlights how powerful brand-level insights and trends can be for your sourcing, pricing, and listing strategy.

To help resellers stay ahead, we’ve curated a Q3 Top Brands Guide. After analyzing over 400,000 products sold and $14 million in online sales by Upright Labs users last Q3, we ranked the top-selling brands by total revenue, average price per item (PPI), and total items sold. This data-driven resource offers insights to help guide your strategy this Q3.

Get the Q3 Top E-Commerce Brands Guide!

Upright's team broke down $14 million, 400,000 products, and 100,000 brands in online sales by our users to provide the ultimate guide for Q3.

Whether you’re stocking electronics for students, fine-tuning inventory for Fall, or preparing for holiday demand, it’s crucial to know exactly what’s driving real results. Dive into our Q3 data to boost growth this season with the brands making the biggest impact.

Fast Facts: What’s Selling in Q3?

Here are some of the top-performing brands that crushed Q3 for Upright users in 2024:

Top Brands By Total Dollar Amount Sold:

- 1. Apple – $528,691.35

- 2. Nintendo – $372,617.13

- 3. Coach – $316,756.74

- 4. Nike – $297,442.23

- 5. Sony – $291,329.25

The exact same top five brands held their spots from Q2, but with even stronger sales. Apple’s total dollar amount sold jumped from $369,684 in Q2 to $528,691 in Q3. Nintendo grew from $319,785 to $372,617. This indicates demand for big-ticket electronics, gaming consoles, and tech accessories remains not just steady but accelerating!

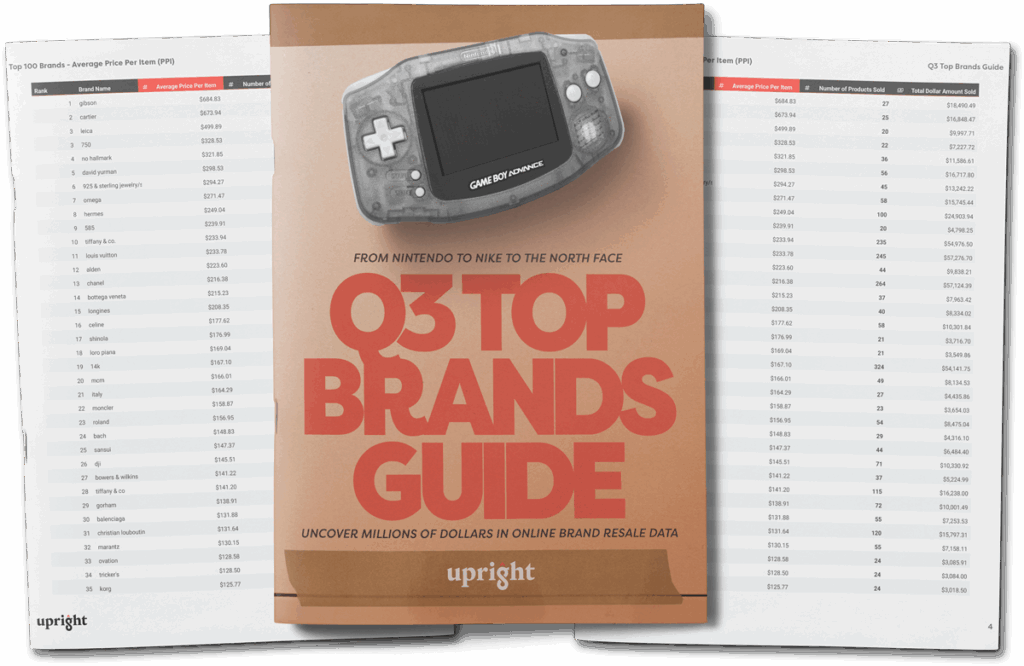

Top Brands By Average Price Per Item (PPI)

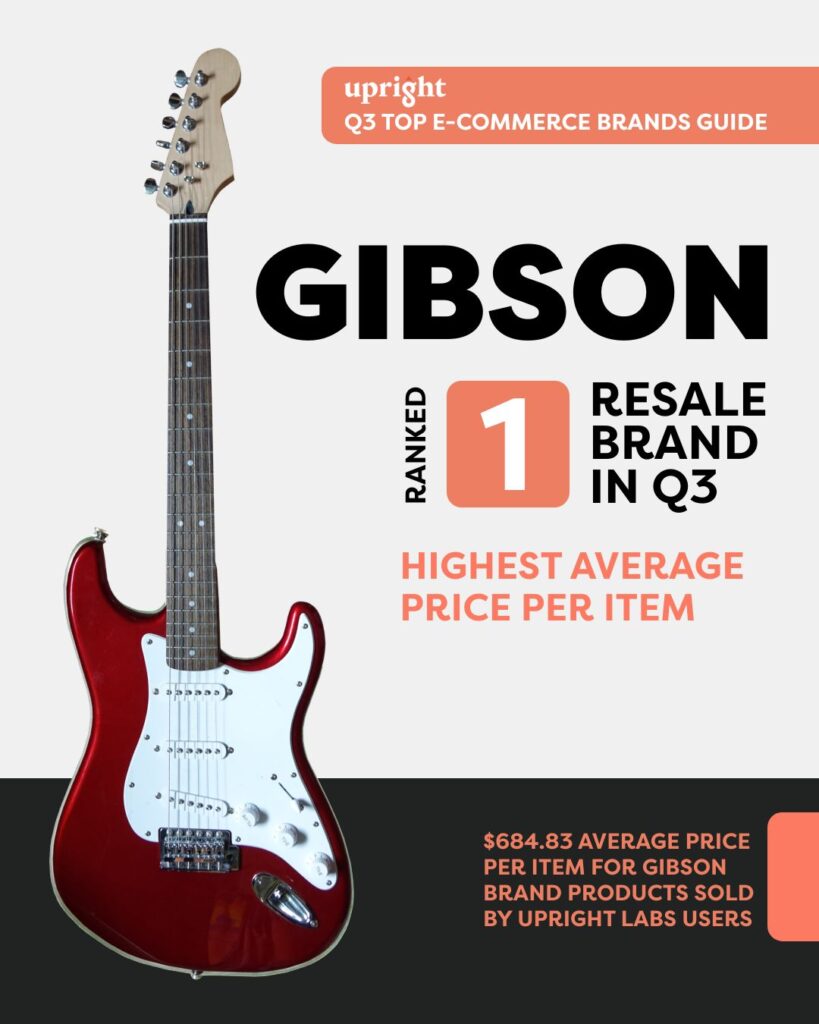

- 1. Gibson – $684.83

- 2. Cartier – $673.94

- 3. Leica – $499.89

- 4. 750 – $328.53

- 5. No Hallmark – $321.85

The big change this quarter? Gibson’s dramatic rise. Last quarter, Gibson was ranked 30th in average PPI at just $143.37. In Q3, it soared to the top spot with an average resale price of $684.83—nearly a 5x increase. New Gibson guitars retail anywhere between $2,000 and $6,000. This makes secondhand a viable option for musicians who want quality at a lower price point than new retail.

Top Brands by Total Items Sold

- 1. Nike – 13,745

- 2. Coach – 11,466

- 3. Nintendo – 7,896

- 4. Michael Kors – 7,013

- 5. Lululemon – 6,823

There is clear growth across the board. Compared to Q2, every brand in the top five sold more items in Q3. Nike jumped from 10,936 items to 13,745 items, while Lululemon grew from 5,581 to 6,823. Data proves that inventory is moving and demand is rising this quarter. It’s a high-volume season with major growth potential for secondhand businesses.

Seasonal Standouts & Category Trends

Q3 bridges Summer and Fall, with seasonal momentum that resellers can leverage.

Back-to-School Boost

Nike and Lululemon saw higher total items sold, driven by demand for sneakers, activewear, and closet staples as families shop for the upcoming school year and extracurricular activities. Electronics brands like Apple and Nintendo also surged, reflecting steady demand for things like laptops and tablets to support students.

Fall Fashion & Transitional Pieces

Fashion brands like Coach, Nike, Lululemon, and Michael Kors moved even more items than in Q2, pointing to shoppers refreshing wardrobes with bags, layers, and accessories suited for cooler weather and fall aesthetics.

Outdoor & Seasonal Gear

Brands like The North Face, Carhartt, and Patagonia might not have cracked the top 5, but they did make the top 15 for total items sold. As temperatures begin to drop, outdoor and seasonal gear are in high-demand this quarter in the secondhand market.

Drive Growth in Q3

Turn data into strategy: stock inventory with brands proven to perform in Q3, use average price per item to price smarter, and focus listings on this season’s trends.

We’ve just touched the surface. The full Q3 Top Brands Guide uncovers hundreds of other high-performing and trending brands to guide your secondhand e-commerce strategy.

Download the Q3 Top Brands Guide now and drive growth this quarter.